SUSTAINABLE FINANCE

A commitment to socially responsible finance

For over 20 years, Groupama Asset Management has integrated the responsible dimension into its investment model.

The organisation of its teams and its range of funds are built on a common ESG foundation consisting of a proprietary ESG analysis methodology, a policy of shareholder commitment to sustainability and transparency, exclusion policies and close monitoring of sustainability risks. In this way, Groupama Asset Management enables its customers to direct their investments towards companies that are helping to build the world of tomorrow with complete confidence.

KEY DATE

OUR ESG APPROACH

SHINING A LIGHT ON INVESTMENT CHOICES

Groupama AM's sustainable investment approach is based on a comprehensive analysis of companies from both a financial and ESG perspective. The aim is to understand how companies are adapting to major changes in society.

To do this, we analyse how each company responds to the risks and opportunities presented by these three transitions. By taking ESG criteria into account, management teams can better anticipate trend reversals and integrate the risks and opportunities facing companies into their investment decisions.

A proprietary ESG analysis methodology

The conviction-based management of our portfolios is based on our proprietary ESG rating methodology. Based on the challenges posed by the three major transitions that form the basis of our analysis, it enables us to effectively identify risks and detect opportunities to add value to companies within their sector of activity. Thanks to an internal rating model, Groupama AM meets the challenges of dual materiality:

- Financial materiality, which determines the negative impact (risks) or positive impact (opportunities) that ESG factors have on the company's financial value.

- ESG materiality, which measures the negative impact of the company's activities on the environment and society.

To limit and reduce the negative impacts of its investments, Groupama AM monitors and measures sustainability risks via the regular meetings of the Sustainability Risks Committee.

OUR COMMITMENT

SHAREHOLDER ENGAGEMENT

Shareholder engagement as a lever for influencing companies to improve their ESG practices and strategies.

VOTING POLICY

Voting at the general meeting is a key feature of the “governance” pillar of Groupama AM’s ESG policy. The Groupama AM voting policy is reviewed annually to incorporate any changes in laws and regulations, governance codes, market practices and the recommendations of our in-house analysts.

Shareholder ENGAGEMENT POLICY

Chaired by the Managing Director of Groupama AM, the Shareholder Engagement Committee meets twice a year with a dual mission: to validate engagement and voting policies and to monitor their implementation via annual reviews.

EXCLUSION POLICY CONTROVERSIAL WEAPONS

In 2009, Groupama Asset Management defined a rigorous policy of excluding investments in companies involved in activities related to controversial weapons, which will be extended in July 2023.

UNDERSTAND SUSTAINABLE FINANCE

A TO Z OF SUSTAINABLE FINANCE

Socially responsible investment is at the core of our corporate culture.

Groupama AM regularly publishes guides, policies and other informative content for all our stakeholders, in particular private and professional investors and our internal partners.

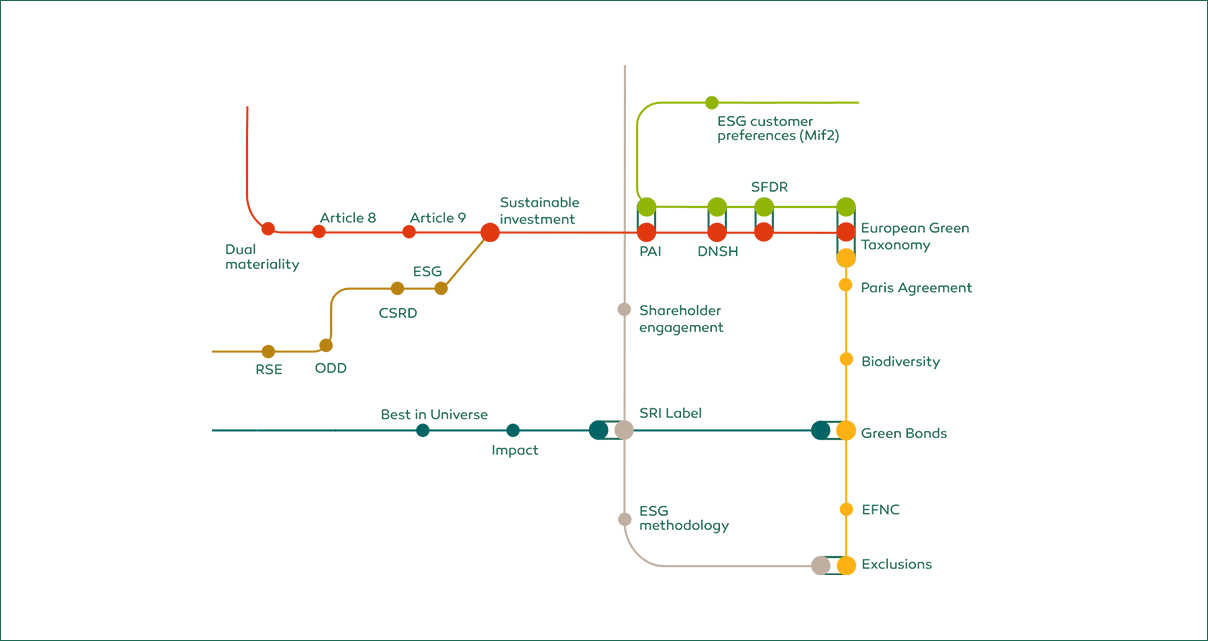

DISCOVER OUR INTERACTIVE METRO MAP

Because it's not always easy to find your way around the many highly specific terms and acronyms used in Sustainable Finance, our ESG team has created this interactive metro map, which provides an overview of the main concepts to remember.