The Bank of Japan (BoJ) announced it would keep its policy rate at 0.50% following its March 18–19, 2025 meeting. The decision, unanimously approved, comes after the 25 basis point hike implemented in January.

The official statements reflect a cautious stance from the monetary authorities. While the BoJ has not revised its assessment of growth and inflation since the previous meeting and reaffirmed its commitment to continue the normalization of monetary policy, the institution does not appear in a hurry to raise rates again. This is largely due to concerns over risks weighing on the domestic economy:

- Uncertainties around U.S. trade policy: Governor Ueda repeatedly emphasized the issue of rising tariffs and external “headwinds” during his press conference. In this context, the BoJ intends to take time to assess how these tariff issues evolve and analyze their impact on Japan’s recovery. Its caution is reinforced by the fact that U.S. trade measures have contributed to heightened financial market volatility.

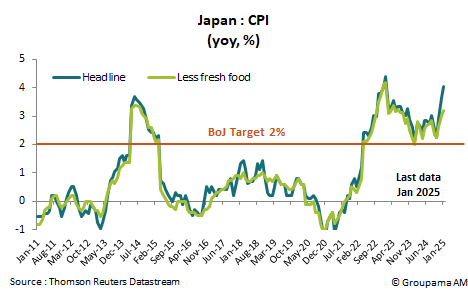

- Rising cost of living and developments in private consumption: The BoJ sees household consumption as weak, especially regarding food and non-durable goods, due to higher living costs. In January, consumer prices rose by 4% year-on-year, significantly above the BoJ’s 2% target (see chart 1). This increase is mainly due to surging prices of grains and energy (+72% for rice). Governor Ueda noted that “the prolonged increase in rice prices means the risk of these rises affecting inflation expectations and public sentiment is not negligible.” As such, the BoJ must remain vigilant, “will need to watch such risks carefully”, and “won't be raising rates when the economy is in very bad shape.” The central bank is now betting on wage increases to sustain a “virtuous cycle.” Early spring wage negotiations have shown “possibly stronger-than-expected” increases.

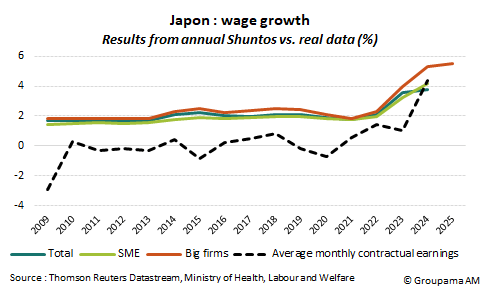

We acknowledge the risk of an economic slowdown in Q1 2025, driven by deteriorating purchasing power (due to stronger inflation) and uncertainty surrounding foreign trade. This has led us to revise down our forecast for Japan’s annual GDP growth from 1.5% to 1.2% for the fiscal year. However, we remain confident in the price–wage momentum. Results from the “Shuntō” spring wage talks among large firms are encouraging (see chart 2). This wage growth, combined with elevated inflation, could add further upward pressure on prices in the coming months.

In this context, the BoJ’s tightening cycle is not over. Its current monetary policy is still far from the “neutral zone” (estimated between 1% and 2.5%). Therefore, the trajectory of wages, their impact on prices and consumption, will be key determinants of the timing of the BoJ’s next move. The resurgence of inflation and yen depreciation pressures may prompt the BoJ to act in Q2. However, several factors could delay the next rate hike until the July 30–31 meeting, including: the arrival of new voting members to the Policy Board in April, the U.S. tariff hikes set to take effect from April 2, and the important elections scheduled for July 20. Whatever the timing, our monetary policy scenario remains unchanged: normalization will continue cautiously, with two additional rate hikes expected, reaching a terminal rate of 1% by the end of 2025.